As with all types of trading, commodity trading comes with inherent and unavoidable risks. Despite the intrinsic nature of these risks, you can take steps to manage and mitigate them – with the right tools. It may be tempting for you to turn to enterprise resource planning (ERP) software to help you trade commodities; however, there are more specialised solutions that may meet your specific business needs. Read on below to learn more about CTRM software and why you need one to succeed in the commodities business.

What Is Physical Commodity Trading?

Physical commodity trading is a type of trading that involves buying, selling, and trading physical commodities. Physical commodities are tangible goods that are extracted or grown, such as agricultural products, minerals, and energy products.

In physical commodity trading, the commodity is bought and sold through a variety of channels, such as futures contracts, forward contracts, and spot transactions. Physical commodity traders buy the commodity with the intention of selling it later at a profit, or they may use the commodity to satisfy the delivery obligations of a futures contract.

Physical commodity trading is an essential part of the global economy, as it allows for the efficient allocation of resources and helps to ensure the stability of prices for consumers. Physical commodity trading also provides an important source of revenue for producers and traders, who can generate substantial profits from the buying and selling of these commodities.

Regardless of the market in which you trade commodities, commodities trading will always involve risks. The management of said risks is often referred to as commodity risk management.

What Are Commodity Trading Risks?

As a whole, the commodity market is complicated due to regulations and the involvement of many products. What’s more, the volatility of commodity prices impacts trading. Because of these factors, commodity risk management is vital.

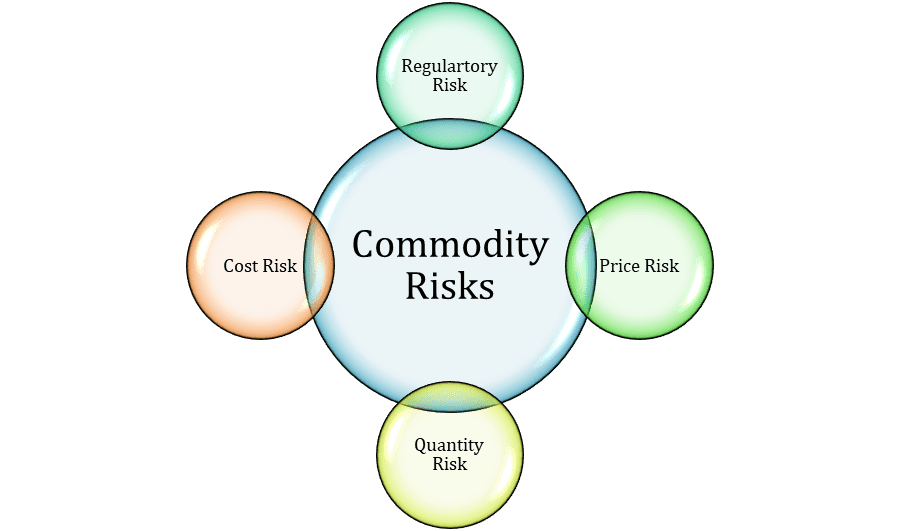

What Are the Different Kinds of Commodity Risks?

Traders are often exposed to the following risks:

- Regulatory Risk. National – or sometimes, even global – regulations may impact the availability and prices of commodities; thus, regulations create risks and affect trading.

- Price Risk. Price risk occurs when commodities’ prices fluctuate due to macroeconomic factors.

- Quantity Risk. The availability of commodities causes quantity risk. Commodities may be in short supply due to natural disasters or regulations.

- Cost Risk. As the name implies, this type of risk occurs when there is a sharp increase in the cost of commodities.

In conclusion, physical commodity trading is complex and carries several risks, which must be carefully managed in order to ensure success.

Which Industries Are Exposed to Commodity Risks?

Commodity price risk is a common challenge faced by many industries, particularly those that use commodities as raw materials, inputs or energy sources. Some of the industries most exposed to commodity risks include:

- Agricultural Industry. The agriculture sector is highly dependent on commodity prices for crops such as wheat, corn, soybeans, and other food products.

- Energy Industry. Traditional sources of energy (coal, natural gas, and oil) and renewable energy are vulnerable to price risks.

- Metal and Mining Industry. This industry is exposed to commodity price risk due to the fluctuating prices of metals, minerals, and other raw materials.

What Is CTRM Software?

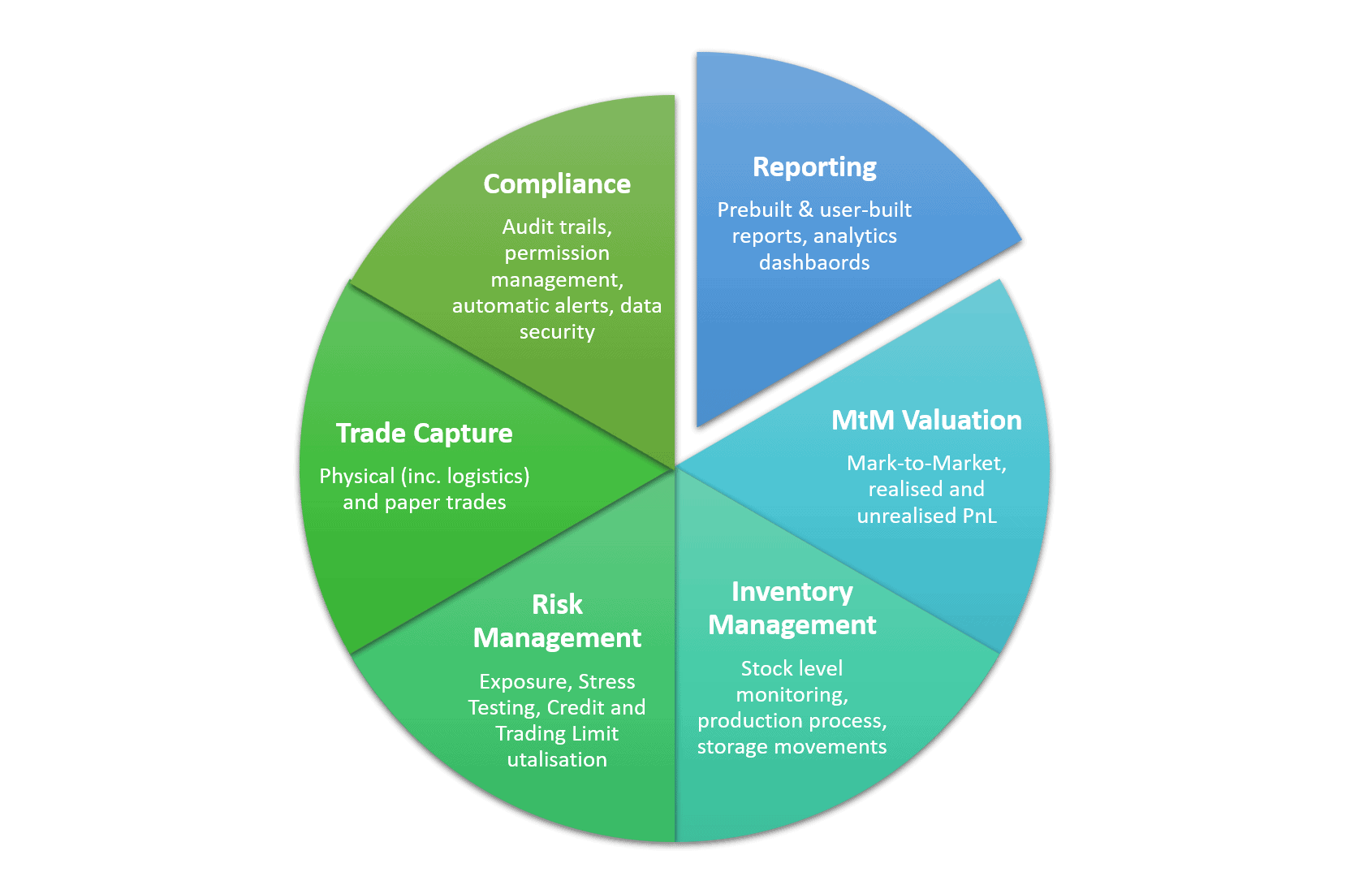

CTRM software, or Commodity Trade Risk Management software, is a specialised tool used by commodity trading companies to manage all aspects of their business. Another term often used in the context of energy is ETRM, for Energy Trading and Risk Management. It captures trades in real time, assesses and mitigates risks, manages logistics and supply chains, automates financial settlement processes, and ensures regulatory compliance. What’s more, you can use it for all sorts of asset classes – including agriculture, metals, and energy.

Unlike ERP systems, which focus on standardising processes, CTRM systems prioritise flexibility to maximise value from market fluctuations and varying commodity qualities. While CTRM systems don’t typically include financial accounting functionalities, they can integrate with accounting systems for real-time data synchronisation.

The following chart illustrates the main components of a CTRM system.

CTRM software aims to replace spreadsheets and older systems that aren’t suitable for today’s complex market. This software also aims to provide a centralised system through which front, middle, and back office workers can work.

Why Do You Need CTRM Software?

The primary purpose of CTRM (Commodity Trade Risk Management) solutions is to provide a comprehensive platform for managing the complexities of commodity trading, from trade capture to financial settlement. CTRM solutions empower commodity trading companies to:

- Boost profitability and cut costs

- Optimise operations and enhance productivity

- Mitigate risks and enhance regulatory compliance

- Make data-driven decisions in real time

- Stay competitive in a rapidly changing market

Trading Compliance

CTRM software is critical in commodity trading compliance. It offers benefits in automation, transparency, risk reduction, and compliance with regulatory requirements. It helps maintain a good business reputation and avoids the risk of financial and legal penalties. For instance, it can automate compliance workflows, provide transparent and auditable records, and ensure compliance with regulatory requirements.

Automation of compliance workflows saves time and reduces errors. It ensures timely completion of tasks such as KYC, AML, and trade reporting. Transparent and auditable records show regulators and management that compliance obligations are met. It can provide quick identification and resolution of issues. Reduction in the risk of non-compliance and penalties helps avoid reputational and financial damage. It improves the quality and accuracy of data, reducing the potential for errors or omissions that could lead to non-compliance.

Improved Data Security

Data security is a top priority for commodity trading companies. CTRM software gives you security that surpasses that of legacy systems such as spreadsheets. It includes role-based access controls, encryption, secure data transfer, and regular updates.

Role-based access controls ensure that users only have access to the data they need. It prevents unauthorized access and reduces the risk of data breaches. Encryption protects data from unauthorized access during transmission and storage. It ensures that data is only readable by authorized users. Secure data transfer ensures that data is transmitted securely between systems. It includes features such as digital signatures and authentication to ensure that data is not tampered with during transmission. Regular updates ensure that the software is up-to-date with the latest security features and patches. It reduces the risk of vulnerabilities that could be exploited by attackers.

Inventory Management

CTRM systems provide real-time visibility into inventory levels, allowing companies to monitor the quantity and status of commodities at all times. Advanced analytics tools facilitate demand forecasting and planning, helping to prevent out-of-stock or overstock situations. CTRM solutions also support accurate inventory valuation based on current market prices and historical costs, which is essential for financial reporting. In addition, they integrate seamlessly with supply chain processes to ensure better coordination between procurement, logistics, and sales.

Increased Efficiency

Aside from creating more accurate insights, CTRM software also increases your efficiency. Your company no longer needs to spend vast resources collecting and aggregating data, as CTRM automated systems can do this without manual supervision; thus, your time and resources are freed up and available for you to put to better use.

Integration allows for seamless data transfer between systems, reducing the risk of errors and saving time. This includes integration with third-party systems such as banks, brokers, and exchanges.

Collaboration enables teams to work together on a single platform, reducing communication gaps and improving efficiency. It includes features such as messaging, document sharing, and workflow management.

Better Risk Management

CTRM systems help companies identify, manage and mitigate various types of risk, including market, credit, operational, and regulatory risks. CTRM will provide a comprehensive view of market conditions. With this data at your fingertips, you’ll be able to manage risks better and reduce the risk of financial loss.

Risk identification involves identifying and assessing risks such as market, credit, operational, and regulatory risks. It enables risk managers to have a comprehensive view of risks and to prioritize risk mitigation efforts.

Risk measurement involves quantifying and measuring risks. It includes tools such as value-at-risk (VaR), stress testing, and scenario analysis. It helps with understanding the potential impact of risks on the business.

Risk mitigation involves implementing measures to reduce the impact of risks. It includes features such as limit management, hedging, and exposure tracking. It helps to reduce the overall risk exposure of the business.

Risk monitoring involves ongoing monitoring of risks to ensure that they remain within acceptable levels. It includes features such as real-time risk reporting, alerts, and exception management. It helps to ensure that risk management efforts remain effective.

What Is the Difference Between CTRM and ERP?

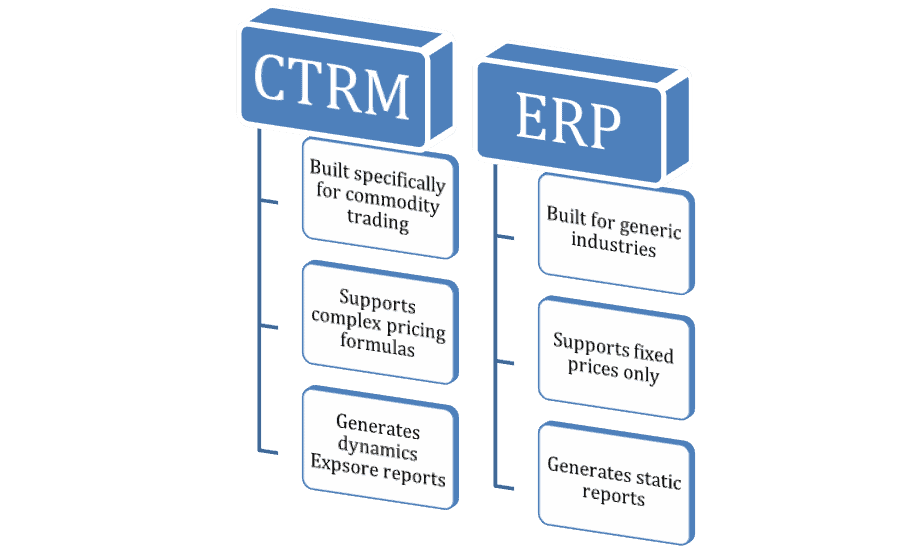

Enterprise Resource Planning (ERP) and Commodity Trade and Risk Management (CTRM) systems are both types of software systems used in different areas of business operations.

ERP systems are designed to provide an integrated view of an organization’s core business processes and functions, such as finance, accounting, human resources, supply chain, and manufacturing. They aim to streamline operations by automating and integrating disparate systems into a single platform.

If you have invested significant time and resources into ERP software, it may be appealing to think that you can use ERP to manage commodities; however, developers did not make ERP software to meet some of the the unique and complex needs of the commodities business.

Contrasting ERP software, a CTRM system is designed to meet the commodities industry’s complex needs. Compared to ERP software, CTRM software are specifically designed for organisations in the commodities trading industry to manage their trading activities, including the buying and selling of physical commodities, and the associated financial and operational risks. CTRM systems enable organizations to manage complex processes such as price discovery, trade capture, risk management, and logistics, and to keep track of contracts, positions, and physical inventory.

Developers build CTRM software systems with flexibility and adaptability in mind. This flexibility is especially vital when it comes to the ever-changing commodities market.

Consider how you buy, sell, ship, store, invoice, account for, and value commodities. Unlike most other manufacturers, commodities businesses have to deal with prices and valuations that can change throughout the supply chain. An ERP system that can only handle fixed prices does little to help commodities buyers with more complex pricing models and formulas.

ERP software, unlike CTRM software, tends to struggle to create contracts where there isn’t a defined price and where various exchanges and exchange types produce monthly, daily, or even hourly market prices. Additionally, they can’t handle dynamic P&L or exposure reporting.

ERP software is not useless. It is more than capable of handling fixed-price procurement situations, such as purchasing raw materials at a fixed price, in a fixed place, and at a specified time. But ERP software will need extensive modifications to handle dealing with commodities and their associated risks. Even then, the most customised ERP systems won’t serve you as well as reasonable CTRM solutions.

In summary, the key differences between ERP and CTRM systems are:

- Purpose: ERP systems are broader in scope and aimed at improving overall business operations, while CTRM systems are focused specifically on the commodities trading industry.

- Functionality: ERP systems offer a wider range of functionalities, while CTRM systems are more specialized, focusing on trade and risk management in the commodities market.

- User base: ERP systems are used by organizations across different industries, while CTRM systems are used primarily by commodities trading organizations.

What Functionality Should You Look for When Choosing a CTRM Solution?

When choosing a CTRM solution, you should look for a system that can handle the front office, middle office, back office, and top management. Below are some specific features you should look out for when comparing possible CTRM solutions.

A good CTRM solution should be able to manage the entire lifecycle of a continuous or single transaction. This includes, but isn’t constrained to:

- Paper trades with OTC swaps (spreads, cracks, and margins), options, futures, and CFDs

- Physical trades with operations, settlements, and logistics – including escalations, multi-currency, and complex formula pricing

- Scheduling and managing transportation by barge, rail, vessel, aeroplane, or truck

- Managing events like title transfer and deal approval

- Inventory management

- Overseeing strategy costs and secondary costs

Using up-to-date market data, your CTRM solution should allow you to track, report, and manage your risks in real time. Functionalities related to this include:

- Risk map of short and long positions, complete with physical and price views for each deal or part of a more extensive portfolio

- Position analysis relating to product types, location, and company

- Stress testing and value at risk calculations (variance-covariance, historical, or Monte Carlo)

- Mark-to-market analysis

- Cash flow simulator and forecasting

- Trading and credit limits

- Keeping track of storage costs, logistics, and their impact on P & L

- Managing freight and demurrage; FFA options, FFA; and spot and time charters

- Actualization and tracking of processes and events (certification, B/L, grading, testing, and sampling)

Regarding the back office, you should be able to configure your chosen CTRM solution to automatically send confirmation notifications to others including management to clear communications and avoid overlapping efforts. Your CTRM system’s back office features should include:

- Monitoring of credit limits

- Receivables/payables and liquidity forecasts

- Invoice generation

- Defining user permissions for updating, creating, deleting, or viewing certain system areas

- P & L cost analysis

Finally, your CTRM software should support the top management by providing accurate and insightful decision-making and real-time monitoring tools. Your company’s top management should be able to make use of your CTRM’s:

- Comprehensive reporting capability

- Customizable analytics interfaces

- Position, P & L, and P & L change reports

What Other Criteria Should You Look for When Choosing a CTRM Solution?

When choosing the best CTRM (Commodity Trading and Risk Management) solution, in addition to functionality, there are several other factors to consider. These include:

- Ease of use: The software should be easy to use and intuitive, with a user-friendly interface that requires minimal training.

- Flexibility: The software should be flexible and customizable, allowing for the addition of new commodities, users, and functionality as the business grows.

- Scalability: The software should be scalable, able to handle large volumes of data and transactions as the business grows.

- Security: The software should have robust security features, including access controls, data encryption, and regular security audits.

- Support: The software should come with reliable and responsive customer support, including training, technical support, and ongoing maintenance.

- Integration: The software should be able to integrate seamlessly with other systems, such as accounting, ERP, and third-party systems.

- Implementation time: The vendor should be able to provide a realistic timeline for implementing the software and integrating it with the business’s existing systems.

- Cost: The software should be affordable and offer good value for money, with transparent pricing and no hidden costs.

- Vendor experience: Look for a vendor with a proven track record and extensive experience in the commodity trading industry. They should have a deep understanding of the industry’s unique requirements and challenges.

- Access to source code: It’s important to choose a solution that provides access to the source code. This allows for greater flexibility and customization, as well as the ability to modify the software to meet changing business needs. In addition, having access to the source code allows for greater transparency and accountability, as the organization can review and audit the code to ensure that it meets their security and compliance requirements. This can help mitigate the risk of software vulnerabilities and ensure the software is secure.

Evaluating those 10 non-functional criteria is crucial to selecting a CTRM solution that meets a business’s specific needs.

Why an On-Premise Solution Might be a Better Choice

On-premise CTRM solutions allow for complete data control, ensuring privacy and compliance. They offer high performance with reduced latency, and are not dependent on internet connectivity. On-premise solutions can be customized to fit a company’s specific needs and can be integrated with other systems easily.

While the choice between on-premise and cloud-based CTRM solutions ultimately depends on an organization’s specific needs and priorities, on-premise solutions are often considered to be better in certain areas. This is because on-premise solutions offer greater control over data security, no dependence on internet or cloud access, higher performance, easier customization and integration, and lower long-term costs. On-premise solutions also allow organisations to fully own and control their software, without being tied to a third-party vendor or platform. This can be particularly important for companies with high regulatory or security requirements, as it allows them to ensure their data is kept secure and meets compliance standards.

In summary, the main advantages of on-premise solutions include:

- Full control over software and data security.

- No dependence on internet or cloud access.

- No limits on system performance.

- Easy customisation and integration.

- Lower long-term total cost of ownership.

In contrast, cloud-based solutions have limited customisation options and may pose security concerns. They require constant internet connectivity, which can lead to downtime or slower performance. However, the choice between on-premise and cloud-based solutions ultimately depends on the specific needs and priorities of the organisation.

Select ComFin Software’s Comcore CTRM Software

ComFin Software’s Comcore CTRM software combines the latest bleed-edge technology with decades of experience in commodity trading and risk management application development. With this combination, you can find in Comcore CTRM the most competitive and feature-rich solution on the market.

The Comcore CTRM software is a complete package featuring front, middle, and back office features. It’s flexible; you can use it as a standalone solution, or you can choose to integrate it into your existing software infrastructures, such as Oracle, SAP, or Navision. What’s more, you can connect Comcore with international futures exchanges at the push of a button to capture trades.

Here’s a bit more of what sets Comcore apart:

- Strong capability in developing tailor-made solutions that overcome your company’s unique challenges

- Consulting and development services backed by renowned industry experts

- User-friendly and affordable services

- Modular licencing – only buy what you need

- No outsourcing or referring to call centres – experts at ComFin Software help you directly

- Elimination of dependency by obtaining the system source code

- User-specific language setting for the entire solution

Comparing ComFin Software with ION Commodities

Let’s compare ComFin Software’s Comcore solution with the solutions of its largest competitor, ION Commodities. It becomes clear that Comcore is a better alternative to ION Commodities in several key ways.

- Comcore is more user-friendly. The interface is intuitive and easy to navigate, even for users with no prior experience with CTRM software. ION Commodities, on the other hand, has a more complex interface that can be difficult to learn.

- Comcore is more scalable. It can be easily adapted to the needs of companies of all sizes, from small businesses to large enterprises. ION Commodities, on the other hand, is designed for larger companies and may not be suitable for smaller businesses.

- Comcore is more affordable. It is priced competitively and offers a variety of subscription options to fit any budget. ION Commodities, on the other hand, is more expensive and may not be affordable for all businesses.

- Comcore offers a wider range of features. It includes features for contract management, shipment management, inventory management, risk management, pricing, hedging, and analytics. ION Commodities, on the other hand, does not offer as many features.

- Comcore offers better support. It has a team of experienced professionals who are available to answer questions and provide deep insights. ION Commodities, on the other hand, does not offer as much support.

Here is a more detailed, independent comparison of the two solutions:

Comcore

- Strengths:

- User-friendly

- Scalable

- Affordable

- Wide range of features

- Excellent support

- Weaknesses:

- Not as feature-rich as some competitors

ION Commodities

- Strengths:

- Feature-rich

- Well-supported

- Weaknesses:

- Complex interface

- Expensive

- Not as scalable as some competitors

Overall, ComFin Software’s Comcore solution is a better alternative for businesses that are looking for a user-friendly, scalable, affordable, feature-rich, and well-supported CTRM solution.

Final Thoughts

If you’re looking for an all-in-one CTRM solution to meet your unique business needs, contact ComFin Software today.

Customers from around the globe have been trusting ComFin Software since 2005 as a reliable leader in developing affordable, comprehensive, and agile financial risk management software solutions.

We have decades of experience assisting companies across the globe to cut their risks in volatile markets by arming them with the resources, knowledge, and administrative processes they need to trade commodities effectively and efficiently.

To learn more about CTRM (sometimes referred to as ETRM) in general, you may also refer to www.pnlexplained.com