The European Union (EU) has proposed a law that would ban the sale of new cars and vans that run on petrol or diesel from 2035 onwards. This is part of the bloc’s ambitious plan to achieve net-zero emissions by 2050 and fight climate change. But the law has faced opposition from some member states, especially Germany, which wants to allow cars that run on synthetic fuels, also known as e-fuels, to be exempt from the ban. How will this law affect the oil trade and what are the opportunities and risks for oil traders? What does it mean for the demand for oil and oil products in the EU and globally? How will it impact the traders who buy and sell crude oil and refined products across different regions? And what are the challenges and opportunities for alternative fuels, such as e-fuels, biofuels, hydrogen and electricity?

In this article, we will provide a detailed analysis of these questions, based on the latest data and research. We will also differentiate between different types of oil and oil products, such as light sweet crude, heavy sour crude, gasoline, diesel, jet fuel and fuel oil. We will structure it into the following subheadings:

- What is the EU’s internal combustion engine (ICE) ban?

- The role of other alternative fuels in the EU’s transport sector

- Challenges and opportunities for synthetic fuels

- How will EU’s ICE ban affect the oil trade?

- What are the opportunities in oil trading?

- The projected impact on oil demand

- The projected impact on oil supply

- What are the market risks oil traders face?

- What is the EU’s internal combustion engine ban?

ICE Ban as part of EU’s Green Deal

The EU’s Green Deal includes a ban on internal combustion engines. The ban targets new cars and vans emitting CO2 from tailpipes. These account for 15% of the EU’s greenhouse gas emissions. From 2035, new cars and vans sold in the EU must have zero CO2 emissions. This effectively excludes petrol or diesel vehicles. Intermediate targets for 2030 aim to reduce average CO2 emissions by 55% compared to 1990 levels.

The EU argues that the ban is necessary to achieve its climate goals, as the average lifespan of vehicles is 15 years and the bloc aims to become carbon-neutral by 2050. The ban will also have significant implications for air quality and public health, as internal combustion engines emit not only CO2 but also other pollutants such as nitrogen oxides (NOx), particulate matter (PM), carbon monoxide (CO) and volatile organic compounds (VOCs). These pollutants can cause respiratory diseases, cardiovascular problems, cancer and premature death. According to a study by the European Environment Agency (EEA), air pollution caused by road transport was responsible for more than 400,000 premature deaths in Europe in 2018.

Some EU member states, led by Germany, have pushed for an exemption for ICE vehicles running on e-fuels. E-fuels are made from hydrogen and captured carbon dioxide and are considered carbon-neutral. Germany argues e-fuels are a viable alternative to electrification for heavy-duty vehicles and long-distance travel. Germany is the largest car producer and exporter in the EU with a strong automotive industry employing 800,000 people. It imports 90% of its crude oil needs.

The EU Parliament approved the ICE ban without the e-fuel exemption in February 2023. The EU Council has postponed the final vote due to growing opposition from countries such as Italy, Poland and Bulgaria. The outcome is uncertain but could have significant implications for ICE vehicles in Europe.

The role of other alternative fuels in the EU’s transport sector

Alternative fuels are defined as any fuel that is not derived from petroleum or its products. They can be classified into four main categories: electricity, hydrogen, natural gas (including compressed natural gas (CNG) and liquefied natural gas (LNG)), and biofuels (including biodiesel and bioethanol). Each of these fuels has its own advantages and disadvantages, depending on the transport mode, the infrastructure availability, the production process, and the environmental impact.

Electricity

Electricity is a versatile and efficient fuel that can power vehicles with zero tailpipe emissions. It can be produced from various sources, including renewable energy. However, it requires a widespread network of charging stations, which are still lacking in many parts of the EU. Moreover, the electricity generation mix can affect the overall emissions of electric vehicles (EVs), depending on how clean or dirty it is.

Hydrogen

Hydrogen is a clean and renewable fuel that can be used in fuel cells to produce electricity for vehicles. It has a high energy density and can be stored and transported easily. However, it also faces challenges in terms of infrastructure development, production costs, and safety issues. Moreover, the production method of hydrogen can affect its environmental performance, depending on whether it uses renewable or fossil sources.

Natural Gas

Natural gas is a fossil fuel that can be used as a substitute or a complement to oil in transport. It has lower emissions than oil and can be cheaper and more abundant. However, it still contributes to greenhouse gas emissions and air pollution, and requires specific infrastructure for storage and distribution. Moreover, it can compete with other uses of natural gas, such as heating or power generation.

Biofuels

Biofuels are liquid or gaseous fuels made from biomass, such as plants or animal waste. They can be blended with conventional fuels or used pure in vehicles. They have the potential to reduce greenhouse gas emissions and enhance energy security by using local resources. However, they also pose risks of indirect land use change (ILUC), food security issues, biodiversity loss, and water consumption. Oil is a complex mixture of hydrocarbons that can be refined into various products for transport, such as gasoline, diesel, jet fuel, or fuel oil. These products differ in terms of their physical and chemical properties, such as density, viscosity, octane number, cetane number, or sulphur content. These properties affect the quality, performance, price, and environmental impact of the products.

The EU’s transport sector consumes about 300 million tonnes of oil products per year, which represents about 60% of the EU’s total oil consumption. The main oil products used in transport are diesel (46%), gasoline (24%), jet fuel (13%), and fuel oil (8%). The demand for these products varies according to the transport mode: road transport accounts for 80% of the demand for diesel and gasoline; air transport accounts for 97% of the demand for jet fuel; maritime transport accounts for 87% of the demand for fuel oil.

Challenges and opportunities for synthetic fuels

Synthetic fuels are fuels that are produced from carbon dioxide (CO2) and hydrogen (H2), using renewable or nuclear energy sources. They are seen as a promising option for decarbonizing sectors such as aviation and maritime shipping, where battery electric or hydrogen vehicles are not feasible.

E-fuels are not widely available or affordable yet and require large amounts of renewable electricity and advanced technology. A study by Transport & Environment estimated e-fuels would cost €3.6-€5.7 per litre by 2030 compared to €1.5 for petrol or diesel. Producing enough e-fuels for all cars in Europe would require more than twice the EU’s current electricity consumption.

Moreover, e-fuels are not entirely carbon-neutral or pollution-free, as they still emit CO2 and other harmful substances when burned in engines. Environmental groups have criticized e-fuels as a distraction from the real solution of electrifying transport and phasing out fossil fuels.

Another challenge is the lack of infrastructure and regulation for synthetic fuels. There are only a few pilot projects and demonstration plants for synthetic fuels in the EU and globally with a total capacity of less than 100 MW. Scaling up synthetic fuels production requires substantial investments in electrolysers, CO2 capture facilities, pipelines, storage tanks and distribution networks. There is no harmonized framework for certifying and labelling synthetic fuels as low-carbon or renewable, creating uncertainty for producers and consumers.

Opportunities for Synthetic Fuels

However, there are also many opportunities for synthetic fuels in the EU and globally. Synthetic fuels have several advantages over conventional fuels, such as:

- They can reduce greenhouse gas emissions by up to 90%, depending on the source of electricity and CO2.

- They can use existing infrastructure and vehicles, with minimal modifications.

- They can provide energy security and diversity, by reducing dependence on fossil fuel imports.

- They can create new markets and jobs, especially in regions with abundant renewable resources.

Competition

Synthetic fuels can also compete with different oil types and products, depending on their quality and specifications. For example:

- Synthetic gasoline can replace conventional gasoline or naphtha, which are light distillates derived from crude oil refining. Synthetic gasoline has a high octane number and low sulphur content, which improves engine performance and reduces emissions.

- Synthetic diesel can replace conventional diesel or gasoil, which are middle distillates derived from crude oil refining. Synthetic diesel has a high cetane number and low sulphur content, which improves engine performance and reduces emissions.

- Synthetic jet fuel can replace conventional jet fuel or kerosene, which are middle distillates derived from crude oil refining. Synthetic jet fuel has a high energy density and low freezing point, which meets the requirements for aviation.

- Synthetic fuel oil can replace conventional fuel oil or heavy fuel oil (HFO), which are residual products from crude oil refining. Synthetic fuel oil has a low viscosity and low sulphur content, which reduces emissions and complies with the International Maritime Organization (IMO) regulations.

- Synthetic fuels are a promising option for decarbonizing sectors such as aviation and maritime shipping, where battery electric or hydrogen vehicles are not feasible. However, they face several challenges in terms of cost, availability, infrastructure, and regulation. To overcome these challenges, the EU and other regions need to support the development and deployment of synthetic fuels through policies, incentives, standards, and research.

How will EU’s ICE ban affect the oil trade?

The ICE ban will significantly impact demand for crude oil and refined products in Europe. Europe accounted for 13% of global oil demand in 2020 with a consumption of 13 million bpd, 60% used for transport. The International Energy Agency (IEA) estimates Europe’s oil demand will decline by 25% (2.4 million bpd) by 2030 and by 6.6 million bpd by 2040 compared to a scenario without the ban. Europe’s oil demand peaked in 2006 and has been declining due to efficiency improvements, fuel switching and policy measures.

This demand reduction will affect different types of oil differently. Oil is not a homogeneous commodity; it comes in various grades and qualities depending on its origin, density, sulphur content and other characteristics. These factors determine how easy or difficult it is to refine oil into different products, how much it costs to transport it, and how much it sells for in the market. Generally speaking, lighter and sweeter (low-sulphur) oils are more desirable than heavier and sourer (high-sulphur) oils, as they yield more high-value products such as gasoline and diesel, and require less processing and lower emissions.

Classic light sweet crudes with low sulphur content are Brent from the North Sea or WTI from Texas. They are widely used to produce gasoline and diesel for Europe’s car fleet. Urals and Maya are heavy sour crude oils with high sulphur content and low yield of gasoline and diesel. Sweet crude oil is more suitable for producing transport fuels, while heavy sour crude oil is more suitable for producing other products, such as petrochemicals or bunker fuel. The price differential between light sweet oils and heavy sour oils could widen from around $5 per barrel today to more than $10 per barrel by 2040, according to BNEF.

Gasoline and diesel will face the largest decline in demand among refined products. Jet fuel, heating oil, naphtha and fuel oil will be less affected. Gasoline and diesel accounted for 70% of Europe’s transport fuel demand in 2020. Jet fuel accounted for 15% and other fuels for 15%. The IEA projects gasoline and diesel demand will fall by 1.8 million bpd and 1.2 million bpd respectively by 2030. Jet fuel demand will increase by 0.3 million bpd and other fuels demand will remain stable.

What are the opportunities in oil trading?

The EU’s internal combustion engine ban does not mean that oil demand will disappear overnight. There will still be a need for oil products for other sectors, such as aviation, shipping, petrochemicals and heating. Moreover, some countries may seek to export their surplus oil to other markets that have less stringent climate policies. Oil traders can take advantage of these opportunities by diversifying their portfolios, hedging their risks and exploring new markets. For example, they can invest in low-carbon fuels, such as biofuels or synthetic fuels, that can be blended with conventional oil products to reduce emissions. They can also look for arbitrage opportunities between different regions and price benchmarks, such as Brent and WTI.

The ban will also create opportunities for alternative fuels, such as biofuels, hydrogen and e-fuels. These fuels can either replace or blend with conventional fossil fuels to reduce emissions. However, they face challenges such as high costs, limited availability and infrastructure needs. According to the IEA, biofuels accounted for about 5% of Europe’s transport fuel demand in 2020, while hydrogen and e-fuels accounted for less than 1%. The IEA expects that by 2030, biofuels will increase to about 10%, while hydrogen and e-fuels will increase to about 2%.

What are the market risks oil traders face?

The EU’s ICE car ban poses significant market risks for physical oil traders. They must adapt by diversifying portfolios, finding new customers and markets and reducing exposure to price volatility and regulatory uncertainty. One risk is faster than expected oil demand decline leading to oversupply and lower prices. This could happen if more countries adopt similar bans or consumers switch to electric vehicles sooner.

Oil traders also face regulatory and reputational risks. They may have to comply with stricter environmental standards and reporting requirements and higher taxes and fees on carbon emissions. They may face pressure to align business models with the Paris Agreement and UN Sustainable Development Goals.

The upcoming changes pose several additional financial risks for oil traders. For example:

- They may face lower margins and profitability due to lower demand and prices for oil products.

- They may face higher volatility and uncertainty due to changing market dynamics and consumer preferences.

- They may face higher costs and complexity due to changing logistics and infrastructure needs.

- They may face higher competition and pressure from other regions or players that can offer cheaper or greener alternatives.

Need to adapt

To encounter these risks, physical oil traders need to adapt their strategies and operations accordingly. For example:

- They may need to diversify their portfolio and markets to reduce their exposure to ICE cars and Europe.

- They may need to invest in new technologies or partnerships that can help them produce or trade low-carbon fuels or electricity.

- They may need to optimize their supply chain and storage capacity to cope with changing demand patterns and price spreads.

- They may need to monitor the regulatory developments and consumer trends in different countries and regions to anticipate future changes.

- Investing in CTRM software can help overcome challenges by optimizing trading strategies, managing risks and complying with EU standards. CTRM software can track and analyze supply and demand dynamics of different oil types and products. Those include light sweet crude, heavy sour crude, gasoline, diesel, jet fuel, fuel oil, etc.

Benefit from CTRM Software

CTRM software can help physical oil traders monitor the price differentials between various crude grades and refined products, which reflect their quality and availability in the market. These differentials can vary significantly depending on factors such as supply disruptions, refinery outages, seasonal demand patterns, environmental regulations, etc. CTRM software can also help traders hedge their positions using futures and options contracts, which can protect them from adverse price movements and lock in their margins.

Another example is that CTRM software can help assess the potential impact of e-fuels on their business. E-fuels are expected to have a higher production cost than conventional fossil fuels, which could limit their competitiveness and market share. However, e-fuels could also benefit from subsidies or incentives from the EU or individual member states, which could boost their demand and profitability. CTRM software can help traders model different scenarios and evaluate their opportunities and risks.

The EU’s ban on ICE cars is a bold move that aims to accelerate the transition to a low-carbon economy. However, it also poses significant challenges for oil traders who have been relying on ICE cars as a major source of demand for their products. To survive and thrive in this changing environment, they need to be agile, innovative, and proactive.

The projected impact on oil demand

What does this mean for oil demand in the EU and globally? Road transport accounted for 44% of global oil demand in 2020, with passenger cars representing 60% of that share. The EU consumed 15% of global oil demand in 2020. Policies affecting European vehicles will significantly impact oil demand. The IEA’s Sustainable Development Scenario (SDS) estimates global oil demand will peak in 2025 and decline by 25% by 2035. This assumes rapid EV sales growth, reaching 60% of new car sales globally by 2030 and over 80% by 2035. The EU’s ICE ban accelerates the transition to EVs and may influence other regions.

However, the impact of the ICE ban on oil demand will depend on several factors, such as:

- The availability and affordability of EVs and their batteries

- The development and deployment of charging infrastructure

- The production and distribution of carbon-neutral fuels

- The consumer preferences and behaviour regarding vehicle ownership and usage

- The economic recovery and growth after the COVID-19 pandemic

- The oil prices and supply dynamics

Uncertainties

One of the main uncertainties is the role of carbon-neutral fuels in the future transport system. These fuels are produced from renewable energy sources, such as wind or solar power, and can be used in existing ICE vehicles with minimal modifications. However, they are currently very expensive and scarce, as they require large amounts of electricity and water to produce. The IEA projects that under the SDS, carbon-neutral fuels will account for only about 4% of road transport fuel demand by 2030 and 11% by 2035. Therefore, their potential to offset the decline in oil demand from EVs is limited in the near term.

Another uncertainty is the impact of the ICE ban on different types of oil products. Not all oil products are equally affected by the transition to EVs. For example, gasoline demand is more sensitive to EV penetration than diesel demand, as gasoline is mainly used for passenger cars, while diesel is also used for trucks, buses, and other heavy-duty vehicles. Moreover, some oil products, such as jet fuel or petrochemical feedstocks, are not directly affected by the ICE ban at all. Therefore, the ICE ban will have different implications for different segments of the oil market.

According to the IEA, under the SDS, global gasoline demand will peak in 2022 and decline by about 40% by 2035 compared to 2020 levels. Diesel demand will peak in 2025 and decline by about 20% by 2035 compared to 2020 levels. Jet fuel demand will recover from the pandemic-induced slump and grow by about 10% by 2035 compared to 2020 levels. Petrochemical feedstock demand will increase by about 20% by 2035 compared to 2020 levels.

The projected impact on oil supply

The EU accounted for 15% of global oil demand in 2020. The IEA expects the EU’s oil demand to decline by 25% by 2030 and by 50% by 2040 under current policies. However, if the EU implements its ICE ban as proposed, its oil demand could drop by 75% by 2040. This would have significant implications for oil supply in the EU and globally.

First, the ICE ban would reduce the demand for crude oil in the EU, which is mainly imported from Russia, Norway, Iraq and Saudi Arabia. This would lower the prices of crude oil in the global market and create a surplus of supply. The EU’s crude oil imports could fall from about 10 million barrels per day (bpd) in 2020 to about 2.5 million bpd in 2040 under the ICE ban scenario. This would free up more crude oil for other regions, such as Asia, where demand is expected to grow.

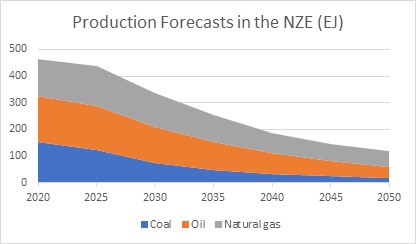

According to the IEA, the use of coal, oil and natural gas declines sharply in the net-zero emissions scenario (NZE) by 2050. Coal use drops from 5 250 Mtce in 2020 to less than 600 Mtce in 2050, a reduction of 88%. This is equivalent to a decrease of about 135 extrajoules (EJ) of energy. Oil demand falls from 88 mb/d in 2020 to 24 mb/d in 2050, a reduction of 73%. This is equivalent to a decrease of about 188 EJ of energy. Natural gas use peaks in the mid-2020s and then declines from 4 300 bcm in 2020 to 1 750 bcm in 2050, a reduction of 59%. This is equivalent to a decrease of about 99 EJ of energy. These reductions are driven by the increasing deployment of low-carbon technologies and carbon capture, utilisation and storage (CCUS) in various sectors.

Source: International Energy Agency (2021), Net Zero by 2050, IEA, Paris

Second, the ICE ban would affect the demand for different types of crude oil and oil products in the EU. Light sweet crude oils, preferred for producing gasoline and diesel, would see reduced demand. Heavy sour crude oils, suitable for producing fuel oil and asphalt, would be less affected. This would widen price gaps between light sweet and heavy sour crude oils and their products.

Third, the ICE ban would increase demand for e-fuels in the EU as alternatives to gasoline and diesel. E-fuels face technical and economic challenges and are not yet commercially viable. A study by T&E estimated e-fuels would cost €3.6-€5.7 per litre in 2030 compared to €1.4 per litre for gasoline and diesel in 2020. E-fuels require large amounts of renewable electricity, water and carbon dioxide to produce. The same study estimated e-fuels would need 43% of the EU’s renewable electricity generation in 2030. E-fuels may not meet ICE vehicle demand after 2035 without significant investments and policy support.

Conclusion

In conclusion, the EU’s internal combustion engine ban will have a significant impact on the oil trade. It will reduce oil demand and prices, and force oil producers to diversify their markets and products. It would also increase the demand for e-fuels as a substitute for gasoline and diesel in ICE vehicles. However, e-fuels are still expensive and inefficient compared to electric vehicles (EVs), which are expected to dominate the EU’s car market by 2035. The ban will also accelerate the transition to cleaner and more efficient energy sources, such as electric vehicles and renewable power. The EU’s decision is a bold and visionary step towards a greener and more sustainable future for Europe and the world.